How the global e-car market has developed - and how it could continue to develop

The sales figures for electric vehicles are reaching new record levels year after year. Current political efforts are not the least responsible for this. In the recent past, financial incentives in particular have purchased vehicles more attractive. Examples include purchase premiums in Germany, France, Luxembourg, Japan and China. Other countries such as Norway and the USA have lowered taxes as financial incentives.

Electric vehicles include pure battery electric vehicles (BEV), vehicles with hybrid drive concepts (HEV) or plug-in hybrids (PHEV) and vehicles with fuel cells (FCEV). Together, these vehicle types are also referred to as xEVs. By far the most significant proportion of these vehicles today is fitted with lithium-ion batteries.

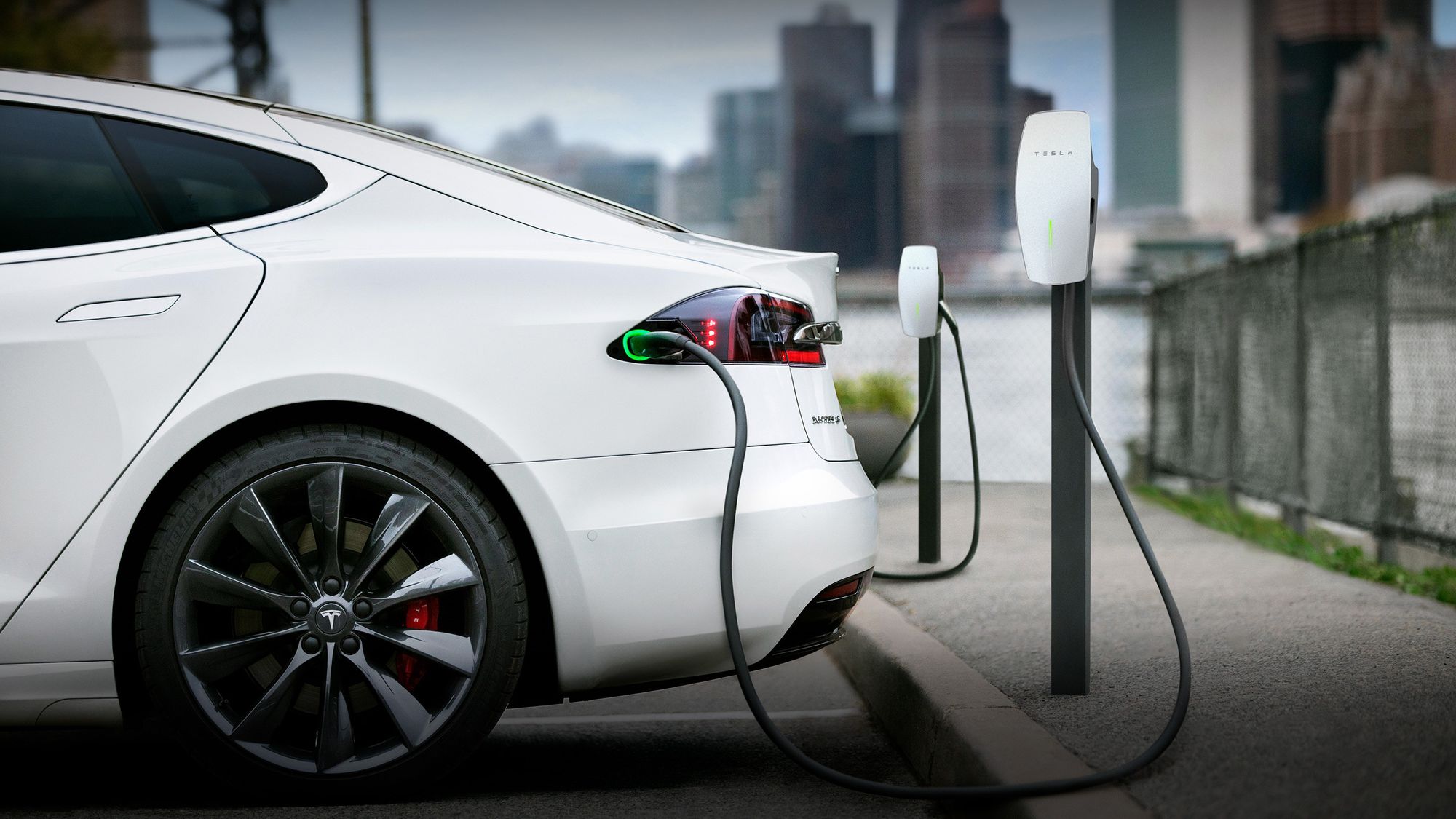

Between 2010 and 2021, global xEV sales increased more than tenfold from around 838,000 to over 9,345,000. While HEVs, led by the Toyota Prius, still accounted for the largest market share among xEVs in 2010 (99.6 per cent), BEVs (47.4 per cent), as pure e-cars, are the most sought-after models in 2021. The best-selling xEV model in 2021 was the Tesla Model 3, followed by the Wuling Hongguang Mini and the Tesla Model Y.

In 2022, the numbers will continue to rise. Thus, sales figures of around 13.4 million vehicles could be reached by the end of the year. Looking at the sales figures up to the end of the third quarter, the largest sales figures are again seen for the Tesla Model Y and 3, as well as the Wuling Hongguang Mini.

In Germany, the increase in sales figures was much stronger than the global development. While less than 6000 vehicles were sold in 2010, last year more than 750,000 were sold. After China (3.67 million) and the USA (1.49 million) as well as Japan (903,000), Germany is the fourth largest vehicle market in terms of sales figures.

The historical dominance of Japan and the hybrid models produced and sold there, primarily by Toyota, can also be seen in the development of sales figures over time. These vehicles were also sold in large numbers in the USA. It was not until the middle of the last decade that the supremacy of the Chinese market became established.

Due to the larger battery in BEVs compared to HEVs or PHEVs, falling cell costs and optimised cell chemistry and cell integration, the average battery capacity installed in vehicles increased from about 1.4 kWh in 2010 to an average of 30 kWh in 2021.